Over the past few weeks, the pay-per-click marketing (PPC) world has been focused primarily on one thing: Google’s new policy on sharing search term data.

A notice on the Google Ads platform stated, “We are updating the search terms report to only include terms that were searched by a significant number of users. As a result, you may see fewer terms in your report going forward.” In a statement to Search Engine Land, Google cited privacy concerns as the reason for the change.

That’s the background of this discussion: Google rolling out a vague new policy saying it will show less search query data of low-volume searches in an effort to protect privacy.

We are now about three weeks removed from this change and, all over, people are starting to see how much data Google is considering “low volume.”

This post is going to dive into what we at Inflow are seeing across our client accounts, as well as some thoughts I have around the future of Google Ads if these “missing” search terms become the new normal.

Many good posts out there are also sharing data from their clients (including this great one from Seer), so we cut up our data differently to provide another perspective. For all data and graphs, we compared 9/3/2020–9/16/2020 (post-change) against 8/3/2020–8/16/2020 (pre-change) to see just what kind of effect this had on our clients.

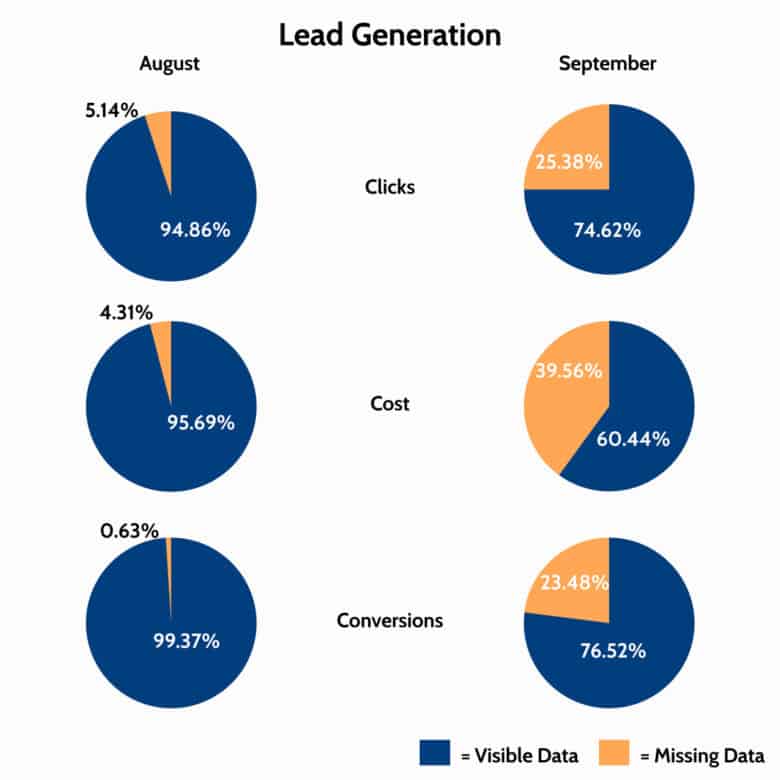

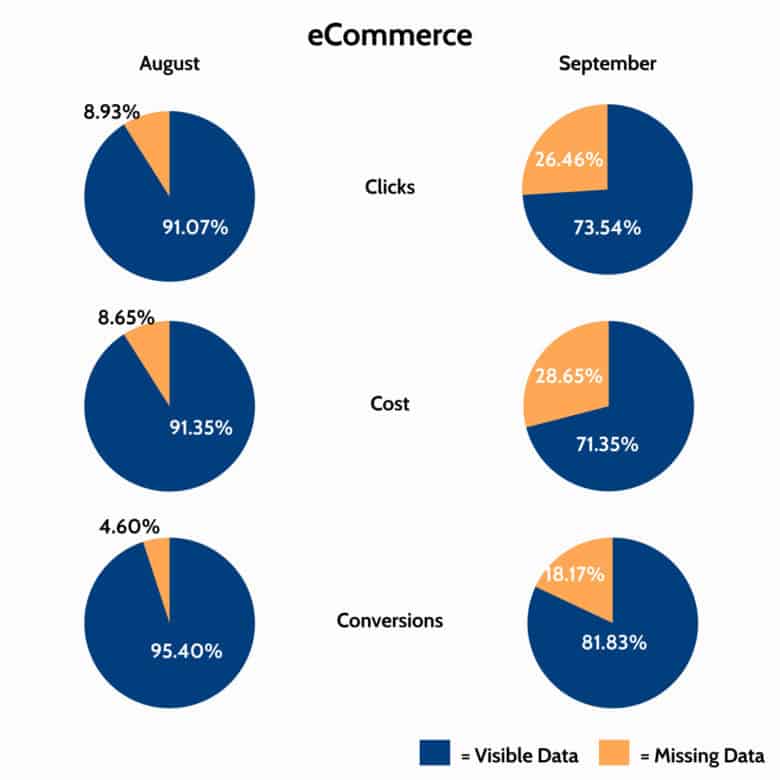

Lead Generation vs. eCommerce Clients

At Inflow, we focus primarily on eCommerce, but we do still have some legacy lead-generation (lead-gen) clients.

So, the first split we looked at was how Google Ads’ increase in “missing” search terms is impacting each group.

Although lead-gen accounts show a smaller percentage of missing clicks than eCommerce after the policy change, the percentage of missing search term cost data is much higher for lead-gen accounts. This is likely caused by a combination of two things:

- Cost per click (CPCs) for our lead-gen accounts are generally higher than the eCommerce accounts.

- From what we have seen, the search terms we lost visibility on have a higher CPC than the ones that we can still see.

The other major takeaway from these data sets is that we went from seeing search term data on over 99% of conversions from lead-gen queries to only seeing about 76%. This means that not only have we lost visibility on what is driving nearly 40% of spend in our accounts, but we have also lost visibility on the good terms that are driving almost a quarter of all conversions.

The eCommerce side of things isn’t as drastic as the lead-gen. However, we still went from having visibility on 91% of the spend to only 71%. We also went from having visibility into 95% of conversions before to only 81% after the change.

Missing 19% of search query data for what converts in eCommerce is concerning. We use search queries to develop our shopping-tiers strategy (our number 1 strategy here), not to mention optimize the current campaigns to cut bad spend and increase conversions.

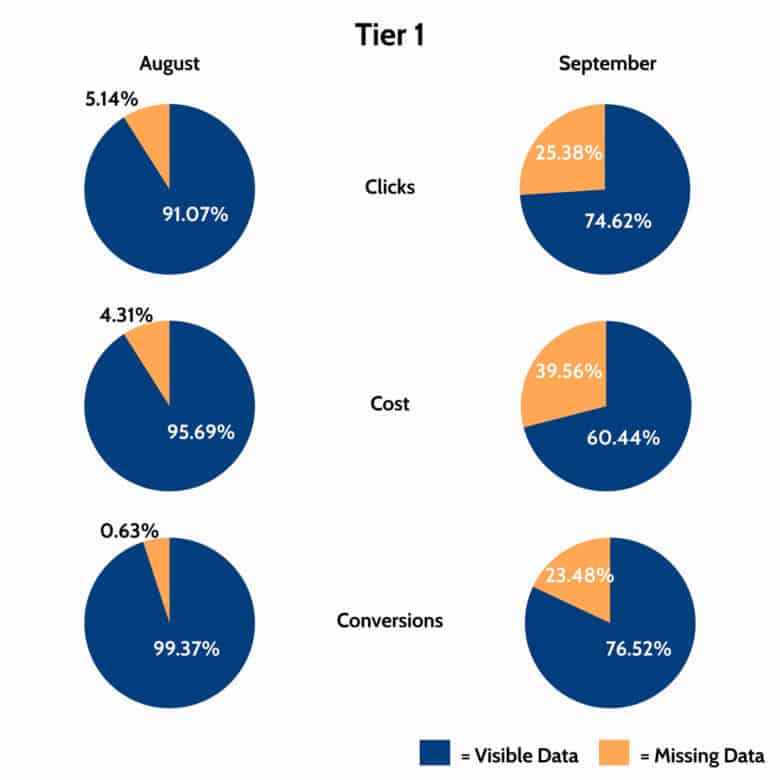

Client Comparison by Account Size

The second cut we did was to look at how Google Ads missing search terms policy impacted different account sizes.

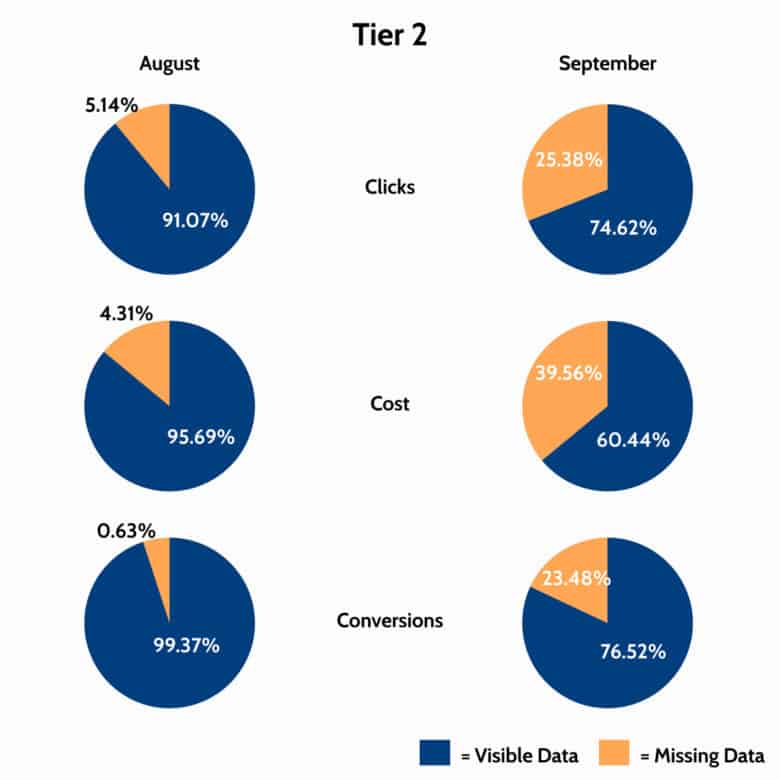

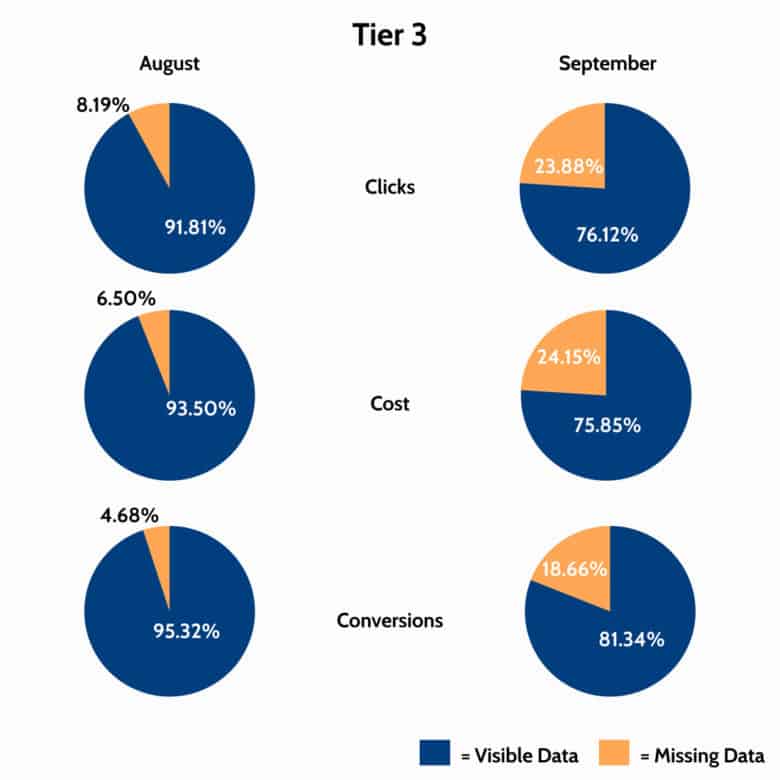

We broke our accounts into three tiers based on the ad spend in September. Tier 1 is low-ad spend, Tier 2 is medium-ad spend, and Tier 3 is high-ad spend. We used these thresholds to get a relatively similar amount of accounts in each tier; they tend to be a good indicator for us on the number of campaigns, types of campaigns, and strategies.

Here is how each tier looked before and after Google’s change to conceal more search query data.

These cuts confirm what we were already starting to see: Smaller accounts are impacted more by this change than larger accounts.

Although the percentage of clicks are relatively close, the percentage of spend missing is 10% higher in both Tier 1 and Tier 2 than in Tier 3. Smaller advertisers are losing more visibility on where their budgets are being spent than advertisers that are spending more per month. This is crazy! Tier 1 and 2 advertisers have less budget and need that data to optimize their campaigns even more.

Don’t get me wrong; ideally, that data shouldn’t disappear for any account, but the fact that it is hurting smaller advertisers more is a major issue.

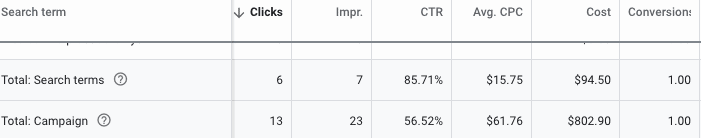

The other thing we noticed was within Tier 2 (medium-spend accounts). Why were we losing so much data in August — before this change even occurred? In asking ourselves, “Why do we have clicks but no search terms in Google Ads?” had we stumbled upon Google’s early tests for this change?

After digging into accounts where we saw a higher discrepancy in August, we can’t find any reason for that missing data. Has anyone else noticed accounts missing some of this search query data in August?

What You Can Do About It

All right, so back to Austin Powers — what does it all mean? How does this change how we set up and optimize accounts?

The short answer: We don’t know yet.

There is currently a petition circulating (started by Marketing O’Clock) that is getting a lot of signatures, but I think this lack of data is unfortunately the new normal, so we have to adapt. The specific action items to take will depend on the account and how many Google Ads search terms missing.

First, we are looking into more testing. Previously I wrote about a target ROAS test on an account, but it may be time to revisit that test because the Google algorithms can still see these missing queries.

Second, it will be more important than ever to use keyword data to pause/adjust bids on keywords with low click-through rates (CTRs) or low conversion rates. Because you will not necessarily be able to see and negate queries coming to that keyword, it may be easier to turn off keywords with high costs and low conversions or in instances when you see the CTRs far below other keywords in the account.

Other ideas we have seen that we will be trying out (most of these come from others in the industry and #ppcchat on Twitter):

- Use Bing search query data to add negatives to Google.

- Add keyword suggestions from Google as negatives that don’t match your intent because, apparently, Google thinks they are relevant.

- Enter your landing page into keyword planner, see what Google suggests, and add the irrelevant ones as negatives.

- Comb through old search queries and add as negatives any bad queries that maybe weren’t significant spend-wasters at the time.

Don’t forget about keeping up with your best practices:

- Conduct analysis and bid adjustments on the time of day, day of week, and device;

- Pending data volume and analysis, consider breaking out the above into their own campaigns;

- Layer in in-market audiences and Remarketing Lists for Search Ads (RLSAs);

- Review demographics performance and adjust accordingly;

- Regularly test ad copy;

- Utilize all ad extensions possible; and

- Get even more granular with your keyword and ad group segmentation.

Ensuring you keep up with all of the above will help mitigate losses on missing search term data and negative keywords research.

A Final Suggestion: Consider Historical Data

Finally, we recommend that while keeping a close eye on overall performance pre- and post-change, keep context in mind, too.

For instance, reviewing our account pre- vs. post-change, we’re seeing about 45% of our eCommerce accounts improve in ROAS. However, where we’re seeing decreases (for the most part) is in accounts that are seasonal, are expanding by testing new strategies (which tend to start at a lower ROAS), or are showing minor fluctuations. Our lead-gen accounts are showing improvements on 40% of the accounts, where the other 60% are either accustomed to more significant swings in cost-per-action (CPA) month over month or are seasonal.

We’ll keep you posted on any other insights as we continue testing. Feel free to do the same!

To speak with an experienced PPC strategist about your Google Ads account, please schedule a free consultation.

0 Comments