Here we are, officially two years into the COVID-19 pandemic. After this winter’s Omnicron wave, some return to “normalcy” seems possible.

But will the eCommerce industry ever be the same?

The impact of COVID-19 on online shopping since March 2020 has been significant. Ripples of the pandemic have upended online businesses’ strategies and results for going on two years now. For some, the pandemic brought a boon; for others, it brought a significant dry spell.

Overall, online shopping rates are up across the board. But, exactly how much has online shopping increased since COVID-19 began?

According to the United States Census Bureau, online transactions grew nearly 32% in 2020 and then surged even higher in 2021, with a 39% growth in Q1 alone.

But it wasn’t enough for online retailers to sit back and let those increased sales come to them. On the contrary, the most successful of those businesses all had one thing in common:

Agility.

In this report, we’ll explore exactly how COVID-19 has affected Inflow’s eCommerce clients (and the eCommerce industry as a whole) to provide some context for this data and inspire innovative solutions for years to come.

Table of Contents

Our Client KPIs: Year-Over-Year Comparisons

In 2020, we published a piece looking at early COVID-19 impacts on eCommerce. Today, we’re sharing what we’ve learned since those first few months.

We’ll take a holistic view of our client KPIs and how they align with or diverge from larger, overall market trends.

A note on our method:

We reviewed 25 of our eCommerce clients and their performance between February 2020 and February 2022. Because our sample size is small, this report should not be considered representative of the industry as a whole.

Instead, it’s an interesting look into the current performance of some top online businesses, including recommendations from our experts on strategy as we continue to move through turbulent times.

Sessions

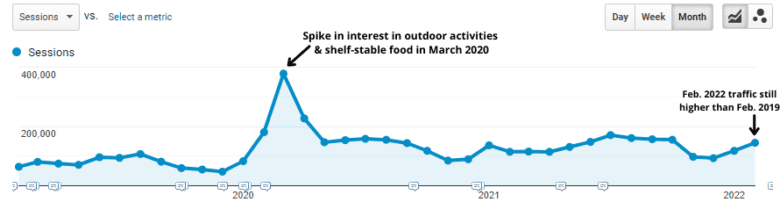

First, let’s look at the number of sessions our clients saw in the first two years of the pandemic.

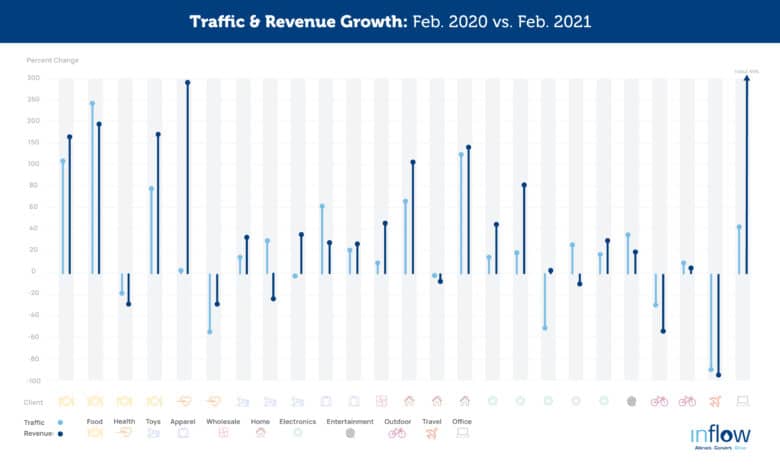

Unsurprisingly, lots of online shopping occurred during early COVID (2020–21) when lockdowns were first instituted. As consumers adjusted to a new way of living that introduced restrictions on mobility, people took to their devices to conduct much of the shopping they would have normally tackled in brick-and-mortar stores.

Throughout the first year of the pandemic, 72% of our clients saw overall traffic increases. Of those clients who saw increases, 66% saw their revenue increase at higher levels than their traffic.

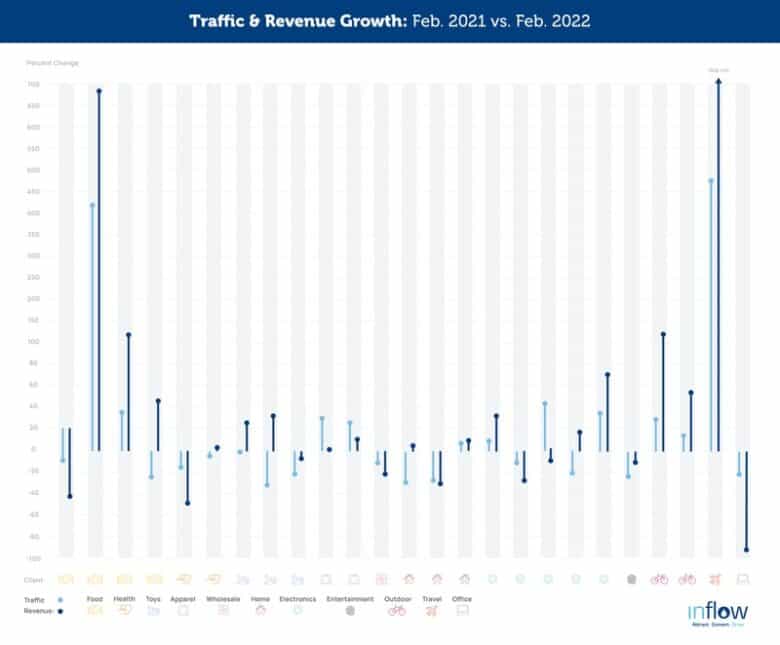

Our SEO team also noticed that, while blog traffic was huge during the beginning of the coronavirus outbreak, it was much less substantial in the pandemic’s second year. Our belief: With the rolling back of restrictions, people weren’t in front of their computers last year as much as they were during 2020–21.

Interestingly, just over half (56%) of our clients saw a decrease in traffic in 2021–22. However, of those clients who saw a decrease in traffic, 42% still saw revenue increases YOY.

Moral of the story: Lower traffic doesn’t automatically equal lower revenue.

If your audience has come to rely on your company having the products they want in stock, they’ll reward you with loyalty. Similarly, if your business has invested in SEO strategies that bring in higher-quality traffic, you’ll see more conversions from those more qualified customers.

Conversion Rates

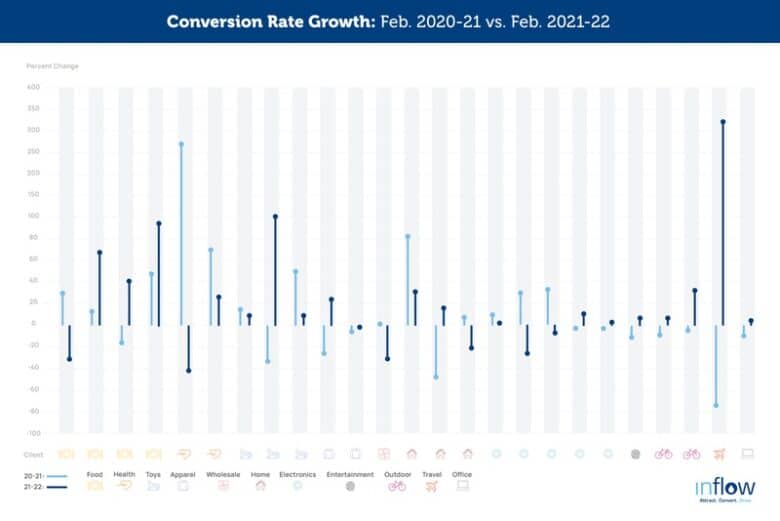

After looking at traffic, we investigated our clients’ conversion rates.

It stands to reason that the eCommerce companies that saw an increase in traffic in 2020-21 also saw increases in conversion rates. Our data shows this to be true.

In the first year of the pandemic, 56% of our clients saw increases in conversion rates. Of those clients, all but one (92%) also saw increases in traffic.

Conversion rates remain strong two years after COVID’s initial hit. In 2021–22, 72% of our clients saw increases in conversion rates. Of those clients, only 66% saw increases in traffic.

Even though our audiences are smaller now than at the start of COVID, those customers who are shopping are more likely to purchase — especially when retailers have invested in effective digital marketing strategies, as our clients have.

Transactions

We’ve discussed how digital window shopping saw a significant boost during 2020–21. But people weren’t just window shopping online — they were also purchasing.

In that first pandemic year, 72% of our clients saw increases in online orders. All of those clients except one saw a subsequent increase in revenue.

Interestingly, the same percentage of clients saw increases in eCommerce sales in 2021–22. However, they weren’t the same clients.

Of those clients who saw sales growth in 2020–21, 61% saw a decrease in transactions in 2021–22. On the flip side, 85% of those who saw a decrease in transactions in 2020–21 saw an increase in 2021–22.

While we can’t conclude any industry-wide trends from our small data set, the variance in transactions do reveal some interesting shopping habits and consumer behavior — namely, that those companies that saw extreme growth during the at-home stage of the pandemic often self-corrected as restrictions began to lift and consumers could continue more of their pre-pandemic social activities (and vice versa).

Revenue

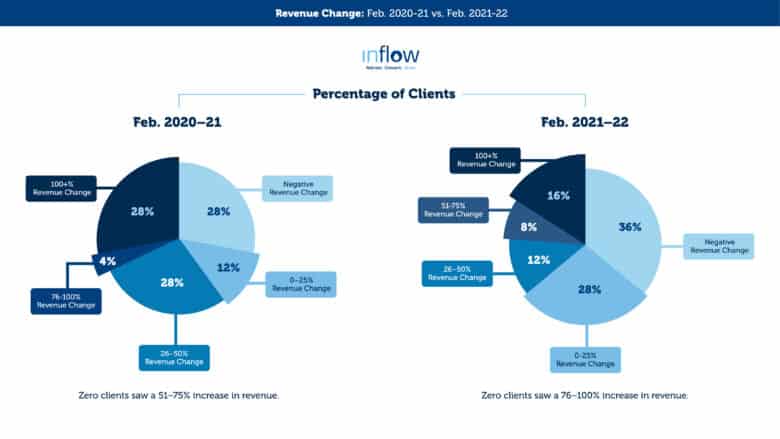

As expected, revenue reflected transactions during our period of study.

Panic-buying helped some businesses surge ahead early on in the pandemic. However, those buying patterns are an exception to the rule and provide an anomaly to be considered when looking at metrics YOY.

In 2020–21, 72% of our clients saw revenue growth. However, just a year later in 2021–22, only 55% of those same clients saw growth in revenue. This was often because the revenue increase in the previous year was unsustainable to replicate.

Of those clients who saw increased revenue in 2020–21, 38% more than doubled their revenue. Making this type of growth a pattern is incredibly difficult, especially as the pandemic recedes and people shift into “new normal” spending habits.

In total, 64% of our clients saw an increase in revenue in 2021–22. Of those, 62% saw increases of less than 50%, reflecting our move back to “new normal” and expected/usual YOY numbers.

Product Categories

New Leaders of eCommerce

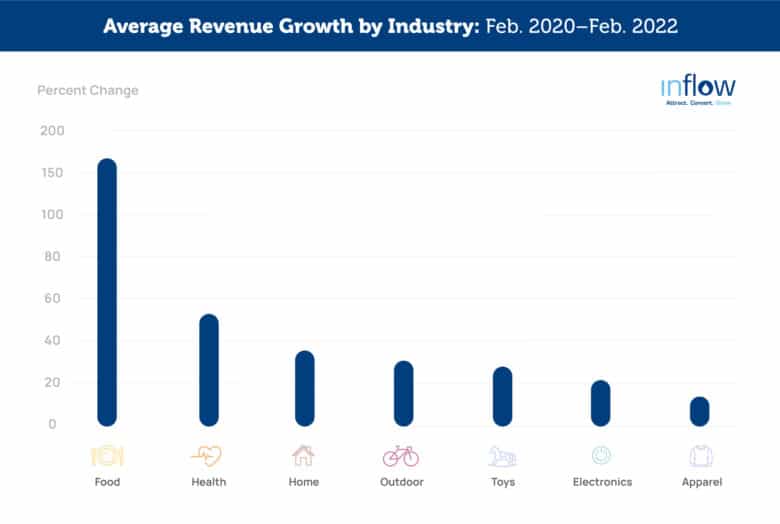

According to McKinsey & Co, some of the top product categories over the pandemic that will likely continue to grow include e-grocery, telehealth, and home goods industries. Google’s data backs these trends (and shares a few new ones).

Because people stayed at and worked from home more than ever before, they started investing in their surroundings more. That includes cooking (e-grocery and grocery delivery) and “nesting” (buying furniture and wares to make the home a more comfortable place or picking up in-home hobbies they didn’t engage in before.)

We’ve seen similar growth and stickiness with our own clients.

Looking at our food industry clients, 75% saw an increase in online sales in the first year of the pandemic and maintained strong revenue growth into 2022. Similarly, the majority of our home industry clients experienced revenue growth throughout the pandemic, as well.

Customers following strict social distancing protocols put in more effort to shop from brands that go the extra mile in terms of health and safety. So, for online grocery and food brands, having the infrastructure to quickly provide COVID-safe and convenient products was a big indicator of long-term success. Being able to offer home delivery services or Buy Online, Pick Up In-Store (BOPIS) curbside options gave some companies a leg up against the competition.

Early Pandemic Winners

Unfortunately, not all products will continue their early-pandemic domination. One example: Our client who sells DJ equipment.

The client saw significant traffic increases during the first year of the pandemic as more people experimented with the artform and improved their at-home setups with product purchases. But, as folks get outside their homes more, traffic has dropped.

Early Pandemic Losers

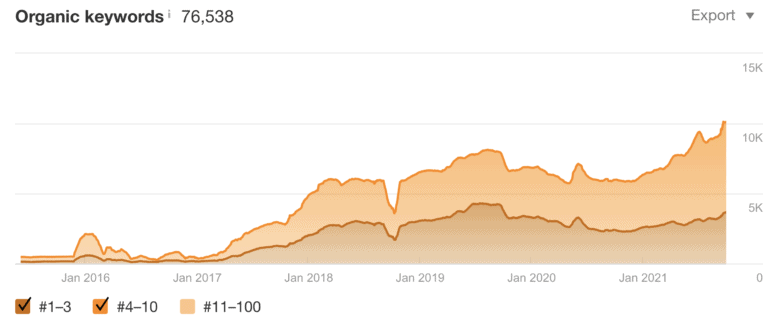

On the other hand, those industries that struggled during their first pandemic year were provided a golden opportunity: rethink their digital marketing strategies to prepare themselves for their industry’s eventual return.

In the slow, lockdown period of 2020–21, one of our travel clients used their free time and resources to complete a much-needed theme migration and continue optimizing their site content. The continued work paid off, setting them up well for the return of travel with:

- Steady keyword positioning in the #1–4 results

- 72% year-over-year keyword growth in the #1–10 results

By keeping an agile approach to their digital marketing strategy, the client significantly improved its long-term SEO efforts. Now that travel bans are lifting, the company is realizing higher sessions, conversions, transactions, and revenue rates.

SEO is a long game, and your brand can reap rewards even when business is closed. Learn more about how we leveraged industry downtime in our complete long-term SEO case study.

Ongoing eCommerce Issues

Agility in product development, supply chain, and digital marketing has been critical for all industries throughout the pandemic. Being able to pivot and experiment with new ways of doing business gave our clients an advantage in this tumultuous period.

Unfortunately, there continue to be many far-reaching impacts of the COVID-19 crisis, some of which we aren’t yet aware.

In this next section, we’re going to share our recommendations for finding short-term solutions for these longer-term challenges.

The next few years will continue to be a balance between finding solutions you can implement quickly while continuing to develop a longer-term system for these industry-wide issues. The more tools you have to pull from, the better, more long-lasting impacts you can have.

Inflation

Labor and shipping costs are going up. Between the pandemic and ongoing issues in Europe, it’s likely we’ll continue to see volatility in the market in various forms.

This kind of dramatic fluctuation can be especially hard for small- and medium-sized businesses — especially when you add in the challenges of finding (and retaining!) reliable staffing and the continually increasing prices of everything from hiring to shipping to manufacturing.

Unless you’re Amazon or Walmart, your business is likely struggling in at least one of these areas.

Your customers are struggling, too. With 64% of Americans living paycheck to paycheck in 2022, shoppers continue to hold back on purchases. And, when they do decide to buy, it’s only after they price-shop to ensure they’re getting the best deal (and we know how difficult it is for retailers to compete with Amazon’s low prices.)

In response to inflation, our clients are:

- Increasing prices

- Opting out of traditional retail sales, like Black Friday/Cyber Monday, because of the inability to mark down prices

- Conducting competitor price auditing

While the first two are often unavoidable for businesses during periods of inflation, the last strategy will help your brand better understand when to pull the trigger on those increases.

By staying up-to-date on what your direct competitors are doing in terms of pricing structures, you can inform your own pricing decisions. Most importantly, you’ll get a better understanding of what’s reasonable for the market to absorb when it comes to price increases in your own brand.

Your competitor pricing is also a big indicator of what your customers will accept as inflation continues to rise.

Competing with Big Businesses

Smaller companies are (and have historically been) having a hard time competing with eCommerce giants like Amazon, especially when it comes to combatting these inflation issues.

Let’s look at just one challenge: shipping.

Independent retailers can’t secure the same shipping contracts that massive corporations can, meaning they’ll end up paying more. And, when smaller retailers can’t keep warehouses staffed, products won’t get to customers in a timely fashion.

While big retailers like Amazon and Walmart can “eat” more of this revenue loss, smaller businesses have to charge more to stay afloat.

Befriending the Behemoths

If you can’t beat them, should you join them? It depends.

For some of our clients, it makes sense to list their products on Amazon and use it as another retail avenue. Joining Amazon means that your company won’t have to worry about ongoing shipping delays. Instead, those will be Amazon’s responsibility, saving your brand from any negative association with those delays. Partnerships with these giants can also ensure more efficient delivery options.

However, while Amazon is quick and convenient for shoppers, it doesn’t always have the best customer service. In addition, it’s difficult to accurately report on how much former website revenue is being replaced by Amazon.

Finally, remember: There will always be customers who prefer to be more mindful when they shop. A number of consumers, especially in the Gen Z cohort, choose to shop elsewhere than Amazon. They purposely seek out independent retailers and company websites to find the products (and shopping experience) they’re looking for.

Even if your brand does partner with Amazon, we recommend focusing your paid search efforts on brand name advertising. This way, you can be found by your loyal, anti-Amazon audience.

After all, you don’t want any third-party retailer (even Amazon) outranking you in branded search efforts.

Product Shortages

Product shortage issues are some of the biggest factors contributing to revenue loss today. Because demand for online shopping spiked early in the pandemic, many supply chains were suddenly overwhelmed. Some have yet to fully recover.

Big businesses like Amazon and Walmart combatted the supply chain issue by snatching up as much warehouse space as they could get their hands on early in the pandemic. Therefore, that shortage of space — and the resulting interruptions in shipping and supply chains — are expected to be an issue throughout 2022.

But it’s not all bad news.

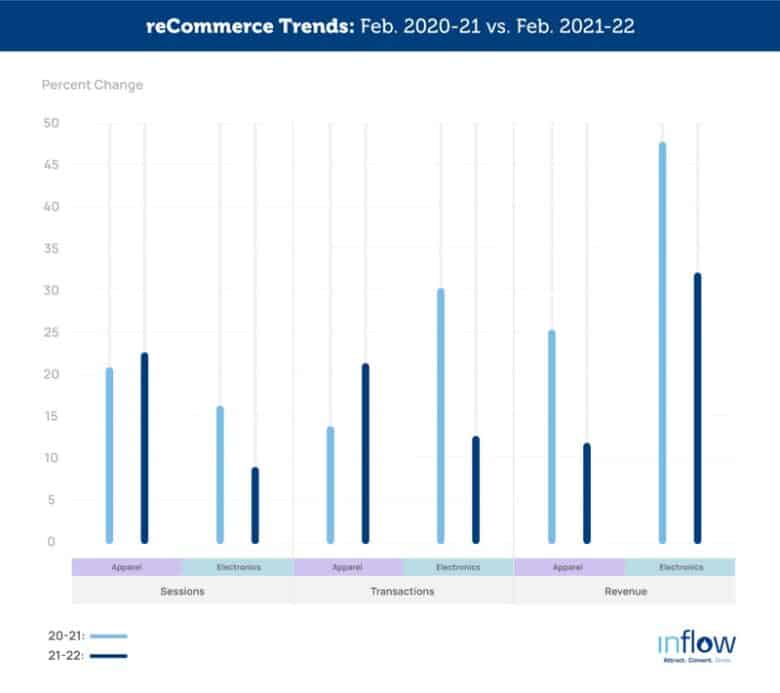

In the face of product shortages, “reCommerce” resellers and used product retailers are doing well. Our reCommerce clients have shown strong growth throughout the duration of the pandemic with sessions, transactions, and revenue.

Unfortunately, clients who sell new products continue to face obstacles.

Because suppliers aren’t providing needed materials, some of our clients have stopped marketing certain products. Even if they can get raw materials they need, brands may not be able to get parts for the machines that process the materials, which can take a long time to get repaired.

Here’s an example:r

One of our outdoor industry clients has a dedicated consumer base, selling products not only on their website but also in other brick-and-mortar retail locations across the country. Because their brand awareness has exploded in the past few years, they can’t create the stock to meet the demand in both buying locations.

Even as traffic has adjusted back to “normal” pre-pandemic levels, the brand continues to experience out-of-stock issues with high-demand products. As a result, this client is missing out on huge revenue opportunities — with no clear solution.

What You Can Do

Out-of-stock issues are going to continue in eCommerce.

The remedy — plan for and strategize around potential solutions.

Here are our common recommendations for clients:

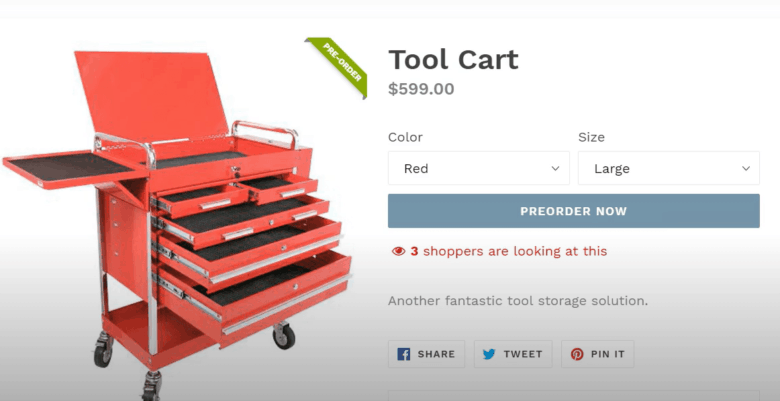

1. Allow backorder options.

If you have an idea of when a product will be back in stock, use this option. Backorder or pre-order capabilities are even available attributes in Google Shopping.

This solution only works if you have a reliable timeframe for product delivery. Otherwise, you could face unhappy customers, have to issue refunds, and lose potential customers.

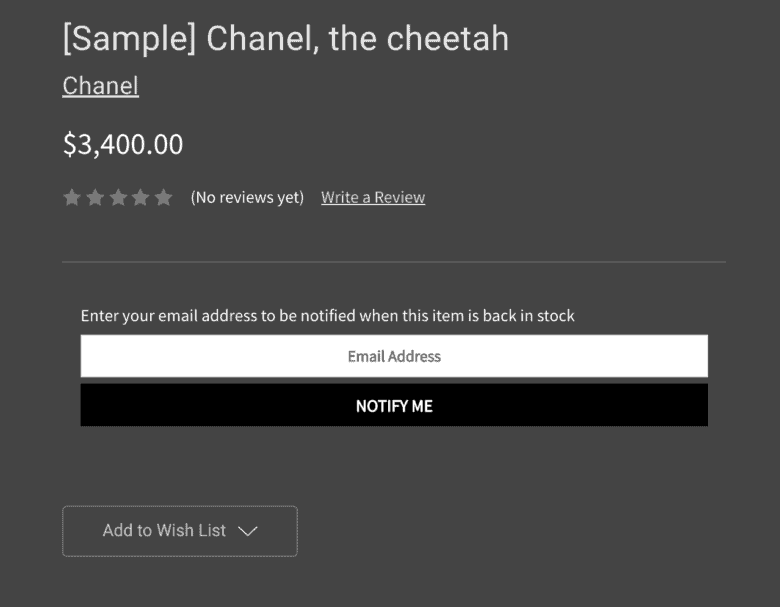

2. Create “back-in-stock” alerts.

Allowing customers to sign up for back-in-stock notifications is a great way to acquire more customer information, grow your email list, and build a relationship — while also holding onto a potential transaction.

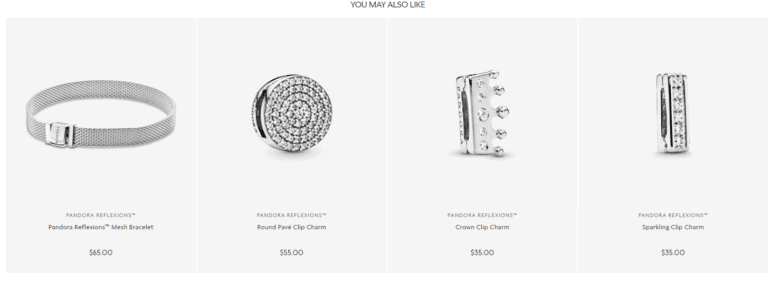

3. Suggest alternative items.

Once shoppers are on your site, you want to do your best to keep them there. Consumers are four times more likely to purchase an alternate item from your page than try to find the original item on a different website.

So, if you have similar products as the out-of-stock item, show your audience those through recommendation engines.

Find more strategies for out-of-stock items with these guides:

- How to Manage Discontinued & Temporarily Out of Stock Products for SEO

- How to Avoid Out-of-Stock Products in Google Shopping & Search

Customer Loyalty

Brand loyalty is no longer a sure thing for eCommerce businesses. In 2021 alone, a combination of supply chain issues and price shopping inspired more than 80% of consumers to buy different brands than they were used to.

If you want to find and retain your customers, your company will need to get creative in offering them what they’re looking for.

Meeting your audience where they are could demonstrate that you have their best interests at heart. If your audience is made up primarily of Millennial and Gen Z shoppers, focus your digital strategy on social media and short-form videos. After all, this is where your shoppers are vetting potential purchases, finding reviews and word-of-mouth experiences, and making online purchases — without even leaving the apps.

Find more strategies for success in our guide to building eCommerce brand loyalty.

Skewed Data & Reporting

Typically, we evaluate KPI reporting in a year-over-year format. But, with 2020 and 2021 being outlier years, we’re reevaluating that approach.

Most online retailers will never compete with the panic-buying levels they saw at the beginning of the pandemic. Trying to compare this year’s performance to last year’s is an inaccurate representation, as is trying to compare 2020 to 2019.

Instead, we’re more often comparing 2022’s performance to 2019’s.

Based on what we’ve seen from our clients, KPIs are returning to more “normal,” pre-pandemic performance. Even clients who saw huge boosts during the pandemic are returning back to usual patterns.

So, here’s our guidance for you:

Consider 2020 a “throwaway” year. Instead, compare future yearly data to pre-pandemic numbers.

There’s no way to compete data-wise with the numbers from 2020. Everything is going to look negative for months and years to come.

To combat negative bias and see your data in a more realistic light, we also recommend looking at estimated industry traffic, not just brand-specific traffic. By understanding your competitors’ performance you’ll better understand how the industry as a whole is performing. (You can view this data in Ahrefs.)

This way, you’ll have a clearer view of whether your brand is in line with what’s happening across the industry — or if you’re underperforming and need a strategy pivot.

An important exception: If you’ve been hit by Google algorithm updates during the pandemic, 2019 may not make sense as a comparison baseline. Just like you would with any algorithm hit in a non-pandemic year, you’ll need to work up from your current baseline to the traffic and revenue levels you strive for.

Creating a Strategy to Outlast COVID

Throughout 2020 and into 2021, plenty of experts claimed that the coronavirus pandemic had sped up the adoption of eCommerce across all demographics. But, two years into this health crisis, we don’t see that as the truth.

Instead, we take a more nuanced view: During the early pandemic, the shift to eCommerce was accelerated to unsustainable levels. Today, trends are ebbing back to a more reasonable cadence.

But that doesn’t mean what worked in 2019 will work in 2022 and beyond.

In our opinion, businesses will have the best chance of eCommerce growth in a post-COVID world if they can be adaptable and provide an omnichannel experience to their customers. Prioritizing agility when it comes to marketing, supply, customer support, and other key factors will help cushion the blow of any coming market disruptions.

If you’re looking for an agency that specializes in eCommerce digital marketing services and stays on top of COVID trends to create customized client strategies, Inflow is here to help. Contact us anytime to request a free audit and proposal that will help your business outlast (and outperform!) in the years to come.

0 Comments